Originally published on Bloomberg by Tim Loh

November 20, 2023 at 1:38 AM CST

Updated on November 20, 2023 at 8:35 AM CST

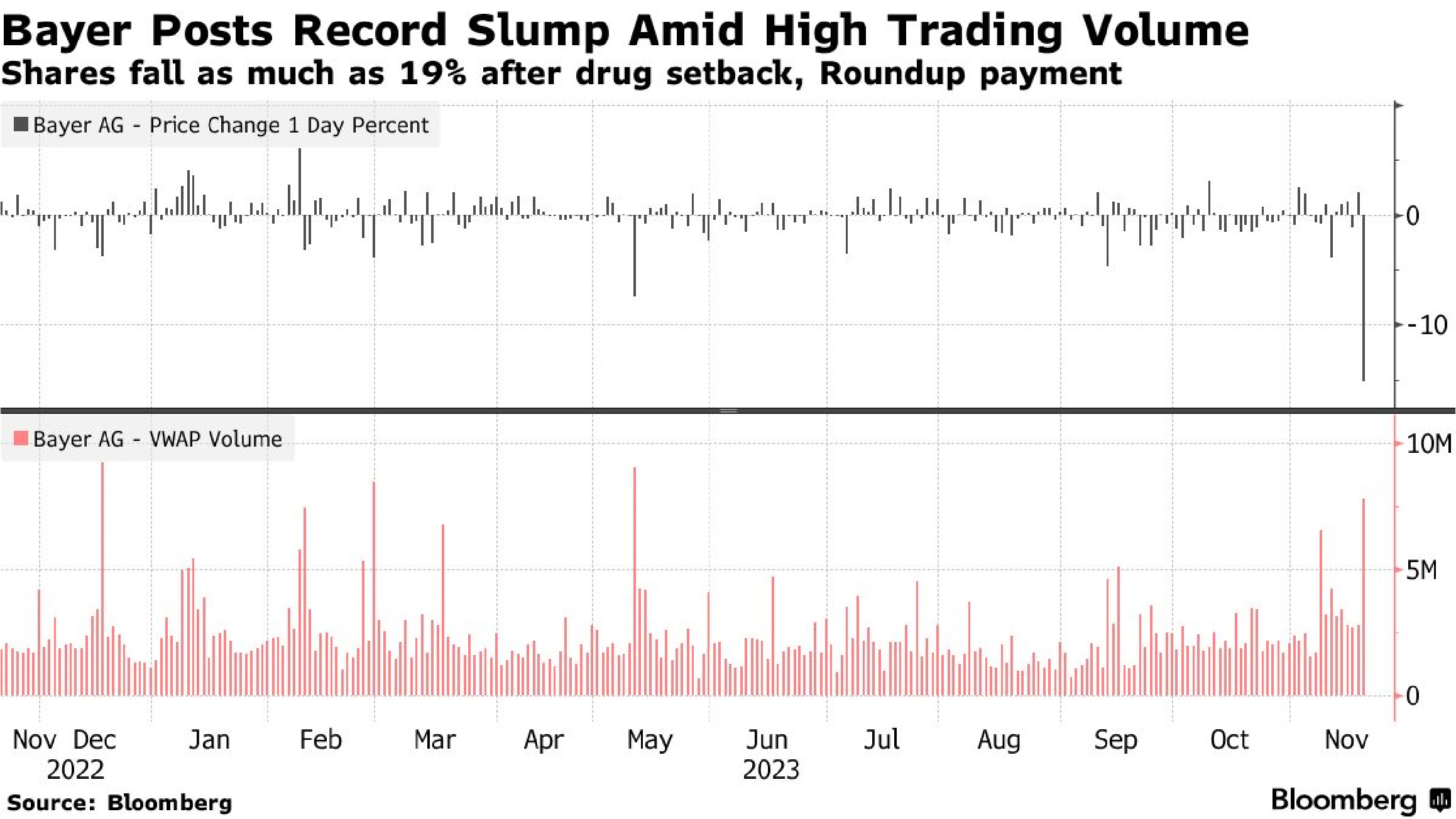

Bayer AG dropped the most in its history, losing about €7.6 billion ($8.3 billion) in market value, after suffering major courtroom and drug-development setbacks that raise pressure on its new leader to outline a turnaround plan.

Five years after the German conglomerate’s $63 billion takeover of Monsanto Co., thehistoric value destruction from that deal continues. There’s no end in sight to the litigation over Monsanto’s weedkiller Roundup after a shock jury verdict on Friday raised the risk that Bayer will have to tap all of, or perhaps even more than, the $16 billion set aside for-related lawsuits.

Meanwhile, Bayer is now facing a separate crisis in its pharma division after halting theprimary study of its most important experimental drug because of a lack of efficacy. Theshares tumbled as much as 21% in Frankfurt trading, dragging Bayer’s market valuationdown to about $37 billion, less than half of what it’s paid for Monsanto and earmarked forthe resulting legal problems.

The events raise the stakes for Bill Anderson, who joined the company this spring and tookover as chief executive officer in June, as he weighs a potential breakup of the pharma,agriculture and consumer health conglomerate.

Investors are hoping Anderson can navigate Bayer out of the thicket of challenges created by his predecessor, Werner Baumann, who orchestrated the Monsanto deal just weeks into11/27/23, 4:27 PM Bayer Slumps Most Ever After Roundup Verdict, Drug Setback – Bloomberg https://www.bloomberg.com/news/articles/2023-11-20/bayer-faces-fresh-blows-on-two-fronts-with-drug-setback-roundup?embedded-checkout=true 3/5

his own tenure. Baumann faced heavy criticism from the start for his decision to buy theagriculture company due to concerns about its reputational problems. Many investors wanted Bayer to use those funds to beef up its pharma division instead.

When Bayer Bought Monsanto, It Didn’t See This Lawyer Coming

Now, the full stakes of Baumann’s bet are becoming apparent. The pharma division isdealing with patent expirations for blockbuster medicines Xarelto, a blood thinner, andEylea, an eye medicine.

The German company said Sunday it had ended a late-stage test for the anti-thromboticdrug asundexian — a therapy billed as a potential blockbuster — due to a lack of efficacy.That’s raising questions about how Bayer’s pharma division will be able to generate growth in the years ahead.

“Asundexian was the pearl of Bayer’s pharma pipeline,” said Markus Manns, a portfoliomanager at Union Investment and a shareholder. Bayer should have found a partner to share development costs and risks with, he said, adding: “Just like with the Monsanto deal,Bayer decided for the much more risky strategy.”

Bristol-Myers Squibb Co., which is developing a similar drug called milvexian, fell as muchas 4.1% at the New York market open. Bristol’s treatment has fast-track designation from US regulators and is being developed in collaboration with Johnson & Johnson.

Bayer’s announcement came two days after its Monsanto unit was ordered by a Missourijury to pay more than $1.5 billion to three former Roundup users who blamed their cancerson the controversial product in one of its largest trial losses over the herbicide.

Monsanto has been hit with a recent spate of jury verdicts finding Roundup containscarcinogens. The more than $1.5 billion verdict is one of the largest damage awards handeddown against a US corporate defendant this year.

Bayer said it will appeal the verdicts and insists the product is safe. Two years ago, thecompany set aside as much as $16 billion to resolve more than 100,000 cases overRoundup’s health impact.

The conglomerate now faces a second wave of lawsuits. The legal risks could complicateAnderson’s efforts to spin offthe agriculture division, if he opts for that path, SebastianBray, an analyst with Berenberg, said in an email.

Bayer is currently in another Roundup trial before a state court jury in Philadelphiainvolving a man who blames the weed killer for his cancer. The jury is still hearingevidence and closing arguments in the case aren’t expected until later this month or inearly December, according to lawyers involved in the case.

Another case is scheduled to start in California in December, with at least three other casesslated to begin in Philadelphia in coming months.

What’s Bayer’s Roundup and Why Is It Controversial?: QuickTake

Aging Drugs

The experimental drug that failed, asundexian, was intended to help drive growth after current best-selling medicines Xarelto and Eylea lose their patent protections in coming years. An independent panel found the treatment underperformed the standard of care when itcame to preventing stroke and systemic embolism in patients with a form of abnormal heart rhythm called atrial fibrillation.

The indication represented about €4 billion of the estimated €5.5 billion in peak sales forthe drug, Thibault Boutherin and colleagues at Morgan Stanley said in a note Monday.They called the study decision “a meaningful negative.”

Bayer will continue another study with asundexian for preventing strokes, though themarket opportunity is smaller, the analysts noted. It will also need to decide whether tomove forward with a test in elderly patients, they said.

— With assistance from Jef Feeley, James Cone, Jan-Patrick Barnert, and Nacha Cattan